Image via WikipediaI learned something interesting and heart-breaking about defamation. I learned that under the law, you cannot defame the dead. In other words, once someone is dead you can legally say anything you want about them, even print falsehoods, and be protected from legal ramifications.

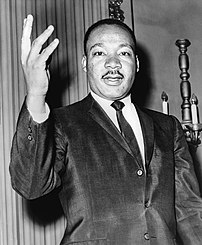

Image via WikipediaI learned something interesting and heart-breaking about defamation. I learned that under the law, you cannot defame the dead. In other words, once someone is dead you can legally say anything you want about them, even print falsehoods, and be protected from legal ramifications.The reason this is relevant is because today is the day that many across the USA honor the memory of civil rights leader Martin Luther King, Jr. A white supremacy group bought the domain mlk.org, and has posted historically inaccurate and hateful speech about the man. Though the family of Dr. King may have a lawsuit due to 'squatters rights', they likely do not when it comes to the defamation of Dr. King.

This would also explain why so many come out with 'tell-all' books once someone has passed away. They can print any ugly, vile, malicious thing they want about the person in question.

How does this apply to you? If you have printed something factual but not pretty about someone who is deceased, you likely have legal protection. It also means that when gathering research about those who are deceased you should use extreme care in which sources you utilize. Those published after the death of the individual may not be accurate.

Source:

Fox News Video - Dethroning the King

If the video does not work, please try this link.

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=8717bb7f-04b3-4953-b6f9-632155bdc3ec)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=999750cd-da7e-4ccb-9320-41872754a2c7)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=dac8fc5f-cf92-44c5-8861-73595586d22b)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=ac88f9a6-02eb-463e-a54d-6acffb0c430f)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b3e9454b-7c23-4e5c-9e38-c75640931036)